Takeaways

- Institutions are still buying Bitcoin and other major cryptocurrencies quietly, often through back channels and slow accumulation.

- They use price dips as buying opportunities, usually aiming for the long term and avoiding flashy headlines.

- This silent support beneath the surface can help steady markets—even when public sentiment feels shaky.

Here’s something funny about the crypto markets: when prices crash, social media panics, but the biggest buyers—the so-called “institutions”—often get quieter, not louder. Lately, while everyone’s watching for dramatic moves or headlines, a lot of the heavy hitters are quietly snapping up Bitcoin and other crypto assets behind the scenes.

Let me explain it in plain English, like we’re chatting over breakfast.

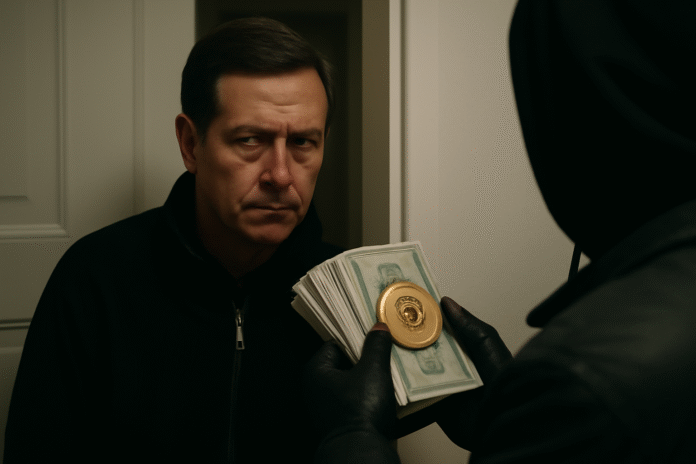

The Secret Accumulators

Have you ever noticed how the news covers every Elon Musk tweet or flashy ETF launch, but nobody talks about all the quietly growing Bitcoin wallets? If you dig into the data (which, admittedly, most people don’t), you’ll see institutional investors—pensions, asset managers, insurance companies, and big hedge funds—have not stopped accumulating. They’re just not taking out billboards about it.

For example, when Bitcoin dipped below $113,000 recently, a lot of retail folks panicked or sat on the sidelines. But under the surface, big funds were using this as a buying opportunity—think of it as Black Friday for banks and Wall Street types. If you peek at on-chain analytics, the number of coins moving into large, untouched wallets is ticking up. No fireworks, just slow and steady.

Why the Low Profile?

Institutions don’t want to telegraph every move. It makes sense: if you’re shopping for hundreds of millions (or sometimes billions), you want to keep prices steady and avoid tipping off the crowd. Unlike retail traders, these folks also have rules and bosses to answer to, so “quiet accumulation” is the name of the game. Some even buy through OTC (over-the-counter) desks, far from the flashy public exchanges, like shopping at Costco after hours while the front doors are shut.

When you see big ETF inflows, muted press releases from asset managers, or tonnes of accumulation in wallets with long periods of inactivity, that’s your hint that the pros are still in the game.

Not Just Bitcoin (But Mostly Bitcoin)

Sure, Bitcoin draws most of the big institutional money—it’s still the digital gold standard. But lately, funds are getting braver, dipping toes into Ethereum and a few other blue-chip coins. They want exposure but not drama, so forget meme coins or super-new projects. The game is about long-term bets on assets they think will survive whatever comes next.

And remember, these big players usually work with five-year plans, not five-day price spikes. So while Crypto Twitter flips out over a $2,000 swing, the suits are thinking, “How will this look by 2030?” It gives you a different perspective.

A Personal Take

Honestly, I find it both reassuring and a little sneaky. When everyone’s shouting about “the end of crypto”, it pays to see where the smart, quiet money is flowing. I think it’s a weird mix of trust and caution—institutions believe in the crypto story, but they’re still careful not to get caught up in the hype. Call it professionalism or just plain self-preservation, but either way, their money keeps coming in. The crypto world is changing, but maybe not in ways you can always see at first glance.