Takeaways:

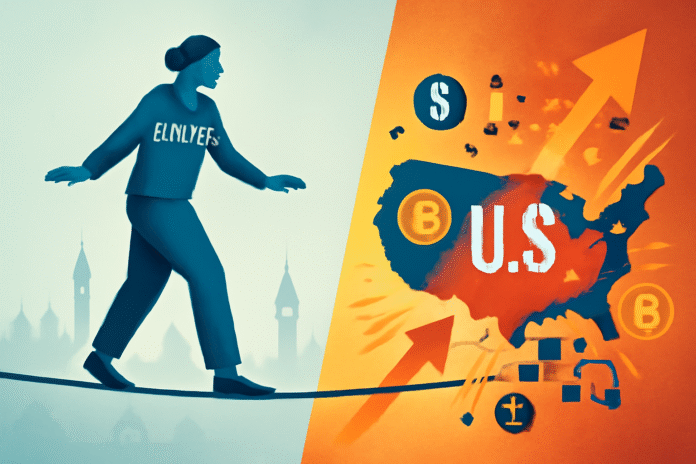

- Europe’s cautious regulatory approach is causing some crypto firms to shift operations to the U.S.

- The U.S. is gaining ground in blockchain innovation despite having looser, sometimes confusing, policies.

- Striking the right balance between safety and speed may be Europe’s biggest challenge moving forward.

There’s something kind of ironic happening in the global crypto space right now. Europe, known for its strong regulatory frameworks, has taken the cautious route with digital assets. Meanwhile, the U.S., for all its political chaos and patchy rules, is somehow pulling ahead in innovation—especially when it comes to crypto startups, blockchain development, and now stablecoin laws.

It’s like watching two friends approach a cliff. One slowly edges forward, double-checking every step. The other just sprints ahead with a grin, maybe tripping a bit, but still getting further. That’s the vibe right now between Europe and the U.S. on crypto.

What’s Going on in Europe?

Europe isn’t against crypto. Far from it. The region has been ahead of the curve when it comes to formal regulation, like the MiCA (Markets in Crypto-Assets) framework. That law tries to bring stability and transparency to the space, which, to be fair, is a big deal. But the process? Slow. Careful. Sometimes frustratingly so.

Regulators are worried about consumer safety, money laundering, and financial instability—all valid concerns. But the result is that innovation feels like it’s being watched through a microscope. And that makes it hard for startups to move fast or take risks.

Some projects that were born in Berlin or Lisbon are now setting up offices in Miami or Austin. Why? Because they feel like Europe’s becoming a bit of a red tape jungle.

Meanwhile, Across the Atlantic…

Then there’s the U.S. Somehow, even with its uneven policies and agencies that don’t always agree with each other, it’s creating fertile ground for growth. Especially recently. We’ve seen new legislation, like the Genius Act (which basically created a stablecoin rulebook), and more big money flowing into American crypto infrastructure.

Places like Silicon Valley still have the capital, connections, and culture to support experimentation—even when things blow up. Sure, there’s risk. But there’s also speed, flexibility, and that “build fast, fix later” attitude.

That difference in mindset? It matters. In tech, moving slow often means missing out.

A Quick Real-World Comparison

Think about how long it took for GDPR (the data privacy law in Europe) to roll out. It was massive and complex and caused companies to rethink how they handle data. Now imagine trying to build a blockchain product while constantly checking that you’re 100% compliant with every new rule—before you even go live. That’s what a lot of European developers are facing.

Meanwhile, in the U.S., founders just launch first and sort out compliance later. Not always ideal. But it does mean things get built faster.

A Personal Thought

There’s a real tradeoff here. Europe wants to avoid another FTX-type collapse, which is completely understandable. But if you’re too cautious, you might end up regulating innovation out of your backyard. And that would be a shame because Europe has some of the best technical talent and ideas out there.

It’s not about ditching the rules. It’s about finding the right pace—and maybe giving startups a little more breathing room before wrapping them in layers of legislation.